Crude Oil Price Outlook: WTI Reversal Approaching Initial Targets

For upon |Crude price reversal targeting initial resistance targets- Interim bullish invalidation at 67.14

Crude prices are up nearly 7.5% off the August lows with the reversal now approaching the monthly opening-range highs. Here are the updated targets and invalidation levels that matter on the Crude Oil price charts this week.

CRUDE OIL DAILY PRICE CHART (WTI)

(Click on image to enlarge)

Technical Outlook: In my previous Crude Oil Price Outlook we noted that “Daily confluence support rests at 64.55/66 where the 61.8% retracement of the yearly range converges on the 200-day moving average and down-slope support. Broader structural support rests at the lower parallel (blue) / June lows at 63.57– We’re looking for a reaction / possible exhaustion off one of these levels.” Price registered a low at 64.40 the next day with the subsequent reversal clearing channel resistance / monthly open at 68.39 – constrictive.

CRUDE OIL 240MIN PRICE CHART (WTI)

(Click on image to enlarge)

Notes: A closer look at crude sees price trading within the confines of an ascending slope formation with a breakthrough and test of the monthly open resistance as support, keeping the focus higher in price. Interim support rests at 68.39 with near-term bullish invalidation now raised to the lower parallel / 2010 low at 67.14. Initial resistance targets are eyed at 69.82/89 backed by the trendline confluence around ~70.40 and a more significant Fibonacci confluence at 71.10/21.

Bottom line: Crude has responded to key longer-term structural support and leaves the risk-weighted to the topside while above 67. Ultimately a breach above the objective monthly opening-range highs would be needed to validate resumption of the broader uptrend.

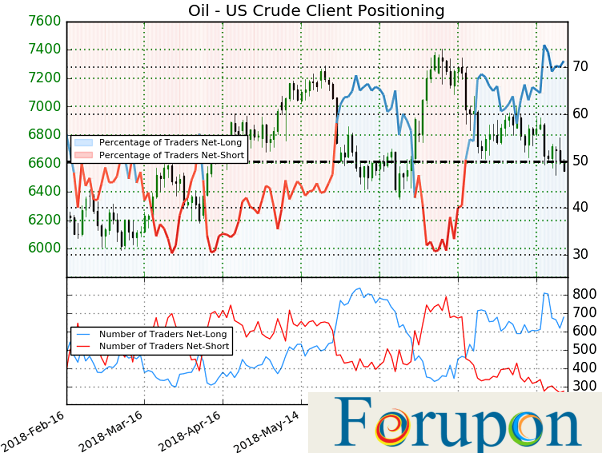

CRUDE OIL TRADER SENTIMENT

(Click on image to enlarge)

- A summary of IG Client Sentiment shows traders are net-long Crude Oil – the ratio stands at +1.39 (58.1% of traders are long) – weak bearish reading

- Traders have remained net-long since July 11th; price has moved 3.5% lower since then

- Long positions are1.4% lower than yesterday and 16.3% lower from last week

- Short positions are 7.4% higher than yesterday and 41.2% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Crude prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Crude Oil price trend may soon reverse higher despite the fact traders remain net-long.

The article was originally published here.

Comments are closed.