Most of us have used the services of a bank to transfer money, do we need a bank just to transfer money? To transfer money to a friend who is sitting next to me, I need the services of a bank even though there is no physical money transfer. Today, the banks have centralized data and hence the problem. If we were to get into a situation where all of us have the same data, can I just go ahead and transfer money to my friend without the need of the bank?

And as soon as my friend receives the data, he acknowledges, and the database gets updated with both our entries when both of us have accepted the information is correct.

For this to happen, we must get into a situation where there is trust among all participants, and the data is encrypted and secure thus not manipulated. Security, Consensus, and trust are key for this to happen. It must take heavy compute power and very difficult to decrypt data.

If all the participants had the same encrypted dataset and application, and, updates to the encrypted dataset happen on consensus between participating parties will ensure that the hackers will have to find new techniques (regarding processing power and updating multiple databases) to manipulate data that would reside with all participants. A technology that can potentially make this possible is Blockchain.

The Blockchain is possibly the technology solution that can help ensuring data security and synchronize data among all participants thus providing everyone has the same copy of reliable data. Since Blockchain allows only append to previous data, there is no fear of updates to past data.

Blockchain works on the concept of Distributed Ledger. All participants within the Blockchain have the same dataset, and data updates happen on consensus.

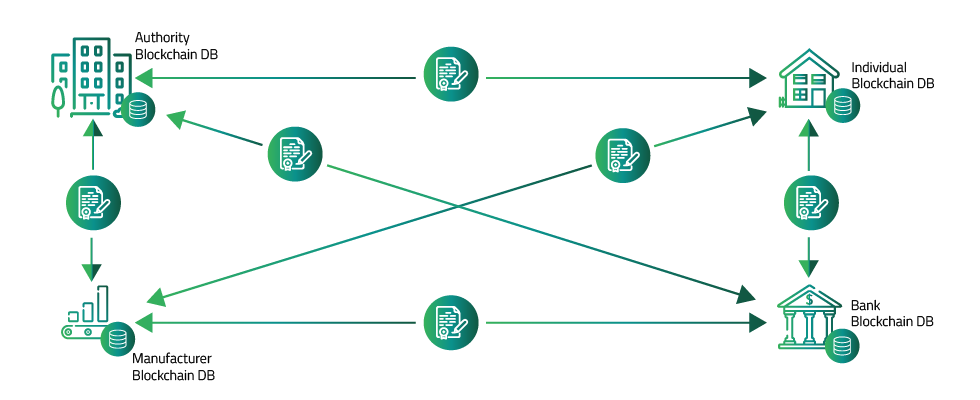

As an example, a vehicle manufacturer has a set of data, when sold to a customer, the bank, the authority, dealer and the individual all have similar data but in an entirely different data store and updates to any of the data store is not reflected in another data store. All individual participating entities have separate database to maintain their data with data being duplicated at multiple places and thus resulting in potential manipulation of data at each of the datastore. With Blockchain, this can change and all participants can have a copy of the same database, thereby all participants have the same copy of the truth

Once the data is written into Blockchain, it cannot be modified; data can only be appended, thus, leaving a complete trace.

Data written into a Blockchain will always have references to the previous appended data and a complete track of how data has changed over a period.

Data will be encrypted, and one-way hashes will help validate if data was ever modified.

Blockchain as technology will do away with centralization and data will be available to all participants making it secure and reduces the need for intermediaries. Data updated in one system or application will be with all participants.

Bitcoin is a Blockchain use case that is currently evolving, in the past few years multiple use cases of Blockchain have started to take shapes, and many organizations have started to bet big on this technology.

Will this be the technology disruption that will reduce the need for a bank like the way email did to post office? Will this be the technology reduce the need for currency printing? Will this be the technology that will do away with the current need for regulatory bodies and centralized systems?

Comments are closed.