What is FICA Tax: Everything You Need to Know

For upon |“What is FICA tax?” is a common question essentially anyone employed will ask at some point. FICA tax refers to one of the types of income tax that everyone working a job must pay.

Your employee must take FICA tax out of your paycheck and send that portion of the money to the IRS. This money then goes toward Medicare and Social Security taxes. Another term FICA taxes are payroll taxes because these taxes are based on how much the employee earns. FICA stands for Federal Insurance Contributions Act. It was first made public in the 1930s with the purpose of having tax to fund Social Security. Several years later, Medicare was added to that.

FICA tax is currently 15.3 percent of someone’s earnings. Both the employer and the employee will pay 7.65 percent. 6.2 percent of the 7.65 percent is used to cover OASDI (Old Age, Survivors, and Disability Program) or more commonly known as Social Security. The other 1.45 percent covers the cost of Medicare. Although the Social Security amount is capped, Medicare is not. Not everyone is required to pay FICA, such as self-employed individuals. Instead, they are subject to different taxation laws, primarily SECA (Self Employed Contributions Act).

If for any reason an employer takes too much Social Security tax from an employee, that employee has to be refunded. If you are a business owner and use some kind of payroll software, you want to confirm that the software isn’t counting the FICA tax as the employee’s income. Intermittently, employers have to send FICA tax deposits and employee withholding to the IRS to cover federal income tax. All deposits are made with EFTPS (Electronic Federal Tax Payment System) and are sent in on a semi-weekly on monthly basis. If you want to learn more about when you should make these FICA and federal income taxes, there is additional information you can read on the IRS website.

In addition to this information, employers have to send Form 941 to the IRS to list information about quarterly payroll tax. These quarterly payroll tax reports must be submitted no later than the last month of every quarter. The reports display the exact amount of money deducted from every employee’s paycheck, anything the employer still owes, and the total paid for that quarter. Although FICA began in the 1930s for employed individuals, it was not until 1954 that SECA (Self-Employment Contributions Act) was created for the self-employed. With SECA, self-employed individuals pay both Medicare and Social Security taxes. 12.9 percent of SECA goes toward Social Security and 2.9 percent goes toward Medicare.

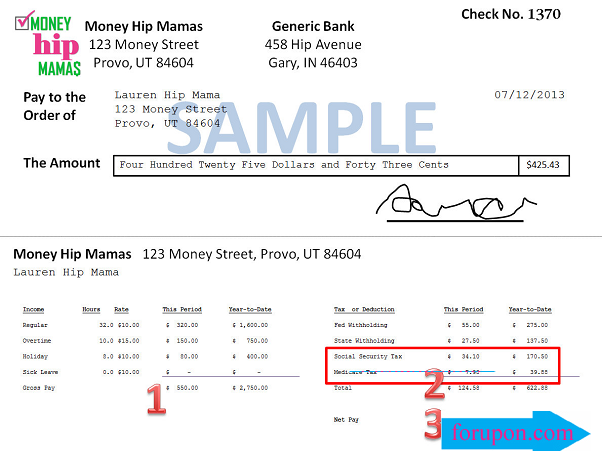

How FICA Tax is Calculated

FICA tax is divided between the employer and the employee equally. Each will pay 7.65 percent of income up to a $127,000 cap. The self-employed person pays both what the employee and the employer pay combined for a total of 15.3 percent of their income. This tax must be reported with your personal income tax return on form Schedule SE. A self-employed individual will look at their AGI (adjusted gross income) and subtract the portion for SECA. Anyone who pays more in withholding tax will receive a refund at the end of the year for anything extra that was paid after the maximum amount was reached. The Social Security cap does not apply to Medicare Tax. For example, if your salary is higher than $200,000, you get taxed .09 percent for Medicare on top of the original 1.45 percent.

You might not know it, but as an employee, you have a lot of say in the percentage amount that you pay in deferral income taxes. Basically, you as an employee can modify your federal and state tax withholding by following an as-needed basis. For example, if you anticipate getting a sizeable federal refund, adjusting your W-4 will play a big role in helping you do that.

Because of the Social Security Act, monthly benefits air paid to over 41 million retirees every month and an additional 60 million other types of beneficiaries on a monthly basis. With FICA taxes, two very key programs designed by the federal government that help senior citizens live financially and physically well off can be funded adequately.

As of 2017, any wages between one penny and $127,000 will be taxed by payroll tax. If a person earns more than $127,000 in a year, they are not subject to any payroll tax. Something that is a bit unusual about FICA tax requirements is that small businesses are required by law to take a portion of their employee’s wages and put that percentage toward FICA. This is unlike the laws set forth for federal and state income taxes. And as previously mentioned in this article, both the employer and the employee have to pay 7.65 percent of earnings to FICA each.

In 2015, a study done by the Social Security Administration revealed that well over 86 percent of payroll taxes went directly toward Social Security. For Medicare, roughly 38 percent of FICA tax went to this program. In the year 2014, The Hospital Insurance Trust received 87 percent of its revenue from FICA tax. As you can see from this information, without FICA tax, these programs (Social Security and Medicare) would struggle substantially at best and cease to exist at worst. And if you are like anyone else, the idea of paying taxes is not a pleasant one. However, after reading this article it is comforting to learn that you are playing an important role in providing a better future for yourself in your retirement along with millions of other Americans as well as the next generations.

Payroll Taxes

As we mentioned earlier on in the article there is an additional 0.9 percent surtax for Medicare. This surtax is not a part of regular FICA taxes and it is something that only the employee will pay. This Medicare surtax (sometimes referred to as the Additional Medicare Tax) does not require the employer to pay into it or match their employee’s 0.9 percent tax. If you are a small business owner who employs individuals, you will take out the 0.9 percent Medicare surtax from their paycheck, but you do not pay your own 0.9 percent tax yourself. Additionally, this 0.9 percent Medicare surtax only kicks in if you have employees who make $200,000 every year.

If you don’t know how to calculate tax amounts, you begin with the Withholding and Employer’s Portion Amounts. Next, take your employee’s gross wage payment and multiply it by the applicable tax rate. The number that you get will reveal to you the amount that you need to withhold along with the amount you will pay in normal Medicare taxes and Social Security taxes. How many withholding exemptions you get as an employee and claim on your tax returns won’t affect the amount that you owe in Medicare and Social Security taxes. When it comes to the Medicare Surtax, the withholding amount is not calculated the same way the Social Security tax (6.2 percent) and the Medicare tax (1.45 percent) are, between both the employer and the employee. The additional 0.9 Medicare surtax is only for the employee (who makes the aforementioned annual salary of $200,000).

Sometimes what the employer owes and what the employee owes are not the same or are “mismatched” when it comes to the surtax liability the employee has. In the eyes of the employed person, that additional Medicare surtax of .09 percent is for any kind of compensation, wages, or self-employed earnings above a certain amount. Only after that threshold has been reached will the tax kick in on any wages subject to the following: the Railroad Retirement Tax Act, the Self-Employment Compensation Act, and Medicare Tax.

Below is a list of the current threshold limitations:

- Couples who are married and filing their taxes jointly with a combined income of $250,000

- A couple that is married but filing their taxes separately with an individual income of $125,000 each

- The head of the household, qualified widow or widower, and single who makes $200,000

We covered the employee’s perspective; but from the eyes of the employer, that 0.9 percent surtax for Medicare kicks in no matter what, even if the employee might not be liable for it. If you are an employer, you need to start withholding that surtax the moment the money you pay your employee is more than $200,000 in one year. Remember that fringe benefits that are subject to tax need to be included in your calculation, however fringe benefits that are not subject to tax do not need to be included. Although you only have to start withholding surtax once the pay amount goes beyond $200,000, once you start withholding, you have to do it for every pay period of the year.

When you start calculating this amount and withholding the surtax, you don’t need to take into consideration any wages your employee might receive from someone else; just what you pay them. In the event that your employee is married and files jointly with their spouse (and their combined income does not exceed $250,000) you will still need to withhold a portion of their paycheck every period of the calendar year. This rule of disregarding the other spouse’s earnings will apply to both spouses even if they both work for the same employer. If you do not withhold the 0.9 percent surtax for Medicare, then the obligation to do so falls on your employee.

If you happen to be a widower or a widow, you could also qualify for a FICA tax deduction. This is also applicable to any children who no longer have their parents who were working as well as anyone currently employed who has a physical or mental disability. When it comes to FICA taxes and what you could expect to pay throughout your lifetime (or more specifically what you will pay while you are working), just keep in mind that what you pay in FICA taxes will basically go directly to what you have in Social Security once you retire.

Part of your FICA taxes is paid by you the employee, while your employer pays the other options; so in a sense, it is like your employer is paying for your retirement. Once again, this split in FICA taxes does not apply to the self-employed individual (under which anyone from a freelance to a business owner could fall). The self-employed person pays both halves of the FICA tax for a total of 15.3 percent. So whatever you earn through your business selling services or products, put away 15.3 percent of your profits or earnings so you can pay your taxes later on in the year. Make sure to download Schedule SE from the IRS website so that you have this form to fill out and submit when tax time comes.

Three Important Takeaways from This Article That You Should Remember about FICA Taxes

The topic of taxes is tricky in general and quite frankly, boring to most people. If you feel overwhelmed by all of this information, just try to remember these three points about FICA tax:

- Social Security tax could change and be adjusted on a yearly basis due to inflation; however, Social Security tax can be capped. For example, in the year 2014, only $117,000 could be taxed in one year.

- And the end of the calendar year, you could receive a refund on your tax return if the amount that you paid in Social Security tax for the year was higher than what is required.

- For the 1.45 percent Medicare tax, there is no cap on wages. As we already discussed earlier in the article, you will actually be paying an extra Medicare surtax of 0.9 percent if you make more than $200,000 in one year.

Need additional information related to FICA taxes? Don’t hesitate to post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers on its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Stripe, and Twilio.

This article was first published here.

Comments are closed.