Old Navy Credit Cards is known for its affordable, yet stylish clothing fit for the whole family. There always seems to be a sale, and it’s rare you won’t find a coupon, promo, or special offer to knock a few more bucks off your purchase.

If you’re shopping at Old Navy, you probably love the savings, so can you benefit from their store-branded credit card? Could it save you even more?

This in-depth review covers each of the Old Navy credit cards, including the similarities and differences, fees and drawbacks, rewards program, the application process, and a whole lot more.

We also cover why you might want to consider an alternative card, especially to avoid the high APR rates of these 4 Old Navy cards.

| Old Navy Credit Card | Old Navy Visa® Credit Card | Navyist Credit Card | Navyist Visa® Card | ||

| Main Benefits |

Earn 5 points per $1 spent across Gap Inc. brands Earn 5 points per $1 spent across Gap Inc. brands |

|

|

|

|

$5 Reward for every 500 points earned $5 Reward for every 500 points earned |

|

|

|

|

|

Exclusive offers throughout the year Exclusive offers throughout the year |

|

|

|

|

|

Early access to popular sales Early access to popular sales |

|

|

|

|

|

|

|

|

|

|

|

|

30% off of your first purchase 30% off of your first purchase |

|

|

|||

Free 3- to 5-day shipping on any online order from Old Navy, Gap, Banana Republic, and Athleta Free 3- to 5-day shipping on any online order from Old Navy, Gap, Banana Republic, and Athleta |

|

|

|||

20% bonus points each quarter 20% bonus points each quarter |

|

|

|||

Free basic alterations on Banana Republic purchases Free basic alterations on Banana Republic purchases |

|

|

|||

|

|

|

|

|||

1 point per $1 spent anywhere Visa is accepted 1 point per $1 spent anywhere Visa is accepted |

|

|

|||

Special Visa cardholder offers and promos Special Visa cardholder offers and promos |

|

|

|||

| Annual Fee |

$0 | ||||

| APR |

25.99% (variable) | ||||

| Late Fee |

Up to $40 | ||||

All 4 cards above are rewards-based co-branded credit cards offered by Old Navy (via Gap Inc.) and issued by Barclays.

As you can see in the table above, there are 2 main types of Old Navy credit cards:

- Basic Old Navy cards

- Navyist “status” cards

These are the base-level credit cards for Old Navy.

This is your basic store-branded credit card, which usually means it can only be utilized for the store it’s branded with: in this case, Old Navy.

Where this differs slightly from other store-branded credit cards is that Old Navy is part of the Gap Inc. family of brands (Gap, Old Navy, Banana Republic, and Athleta), so your card can be used at these stores as well.

The main benefits of the Old Navy card include:

Earn 5 points per $1 spent across Gap Inc. brands

$5 Reward for every 500 points earned

Exclusive offers throughout the year

Early access to popular sales

Zero fraud liability

30% off of your first purchase

This is your basic step up from a store-branded credit card. The Visa distinction means this card can be used anywhere Visa is accepted.

Old Navy Visa cardholders enjoy the same main benefits as Old Navy cardholders (above), PLUS:

1 point per $1 spent anywhere Visa is accepted

Special Visa cardholder offers and promos

These cards are Old Navy’s status cards and you can’t apply for them outright.

The cardholder must achieve the following to earn Navyist status:

- Earn 5,000 reward points (excluding bonus points and returns) within a calendar year

- Make the minimum payment by the due date after reaching the 5,000 points

- Keep their account in good standing

The terms and conditions of this program state that upgrades to Navyist status will be processed within 90 to 120 days after the customer qualifies.

The rewards member must re-qualify each calendar year to maintain Navyist status.

All Navyist cardholders receive benefits on top of those mentioned above for basic cardholders. That means:

Earn 5 points per $1 spent across Gap Inc. brands

$5 Reward for every 500 points earned

Exclusive offers throughout the year

Early access to popular sales

Zero fraud liability

PLUS:

Free 3- to 5-day shipping on any online order from Old Navy, Gap, Banana Republic, and Athleta

20% bonus points each quarter

Free basic alterations on Banana Republic purchases

A dedicated Navyist cardholder toll-free priority line

As with the basic Old Navy card, the Navyist card can only be utilized at Old Navy and the Gap Inc. family of brands (Gap, Banana Republic, and Athleta).

This is the upgraded version of the Old Navy Visa card, so like that card, it can be used for purchases anywhere Visa is accepted.

In addition to the perks above, the Navyist Visa card includes:

1 point per $1 spent anywhere Visa is accepted

Special Visa cardholder offers and promos

Hot Tip: Navyist cardholders can receive their free 3- to 5-day shipping on any online order from the Gap family of brands by using code NAVYIST at checkout.

Additional Visa Card Benefits

In addition to all of the perks above. Being a Visa cardholder entitles the rewards member to a few additional benefits.

Chip and signature technology

Cardholder inquiry service

Lost or stolen card reporting

Emergency card replacement and cash disbursement

Auto rental collision damage waiver

Roadside dispatch (a pay-per-use system)

Earning Points

In general, the credit card rewards program, which is separate from the Bright Rewards program, is pretty simple.

Regardless of which of these 4 cards you have, you’ll earn 5 points for every $1 spent across specific brands in the Gap Inc. family. These points can be earned in-store, online, or directly via phone or mail.

The Gap Inc. family of brands includes:

- Athleta

- babyGap

- Banana Republic

- Banana Republic Factory Store

- Gap

- GapBody

- GapKids

- Gap Factory Store

- Gap Maternity

- Gap Outlet

- Old Navy

- Old Navy Outlet

Reward points are not earned for purchases made at Intermix, Weddington Way, or for the babyGap OutfitBox or Old Navy SuperBox subscription services.

As we mentioned above, if you’re an Old Navy Visa card or Navyist Visa cardholder, you also earn 1 point per $1 spent on all other purchases (wherever Visa is accepted).

Additionally, if you’re a Navyist cardholder, you’ll earn 20% bonus points each quarter, applied to your account once the quarter is complete.

How Rewards Are Issued

Once a Rewards member earns 500 points, a $5 Reward will be issued, which can be used at any of the Gap Inc. family of brands. These rewards are generally issued to the member’s account at the end of each billing cycle.

There is no limit to the number of points a member can earn. However, the max reward that will be issued in any one billing cycle is $250.

It’s important to note that any points that are less than the number required for the lowest reward denomination (<500) will be applied toward the rewards for the next billing cycle. Let’s take a look at an example — if you earn 1,600 points on your Old Navy account, you’ll receive a $15 reward and 100 points will carry forward in your balance for your next billing cycle.

Hot Tip: Cardholders can now utilize their mobile wallet (Apple Pay, Samsung Pay, Google Pay) for in-store purchases.

Using Your Rewards

Each reward issued has its own expiration date, so be sure to check for that and make your purchases within the reward window.

The program states members can redeem up to 3 rewards in a single transaction in-store, but up to 5 rewards if shopping online or purchasing over the phone.

What about stacking? Your rewards can be combined with 1 other promotional offer. Another nice perk is that rewards can be applied toward items on sale at any store location.

If there is any residual amount owed on your purchase after redeeming your rewards, the rewards member must use a Gap Inc. credit card to cover the residual amount, such as the Old Navy card you used to earn your points.

If your account is inactive for 24 months, points earned but not used towards a reward will expire.

Managing Your Rewards

You can find more information on viewing and managing your rewards account in the Login and Online Account Management sections below.

Every credit card has its related fees and drawbacks, and the Old Navy credit cards are no exception.

Fees

| Old Navy Card and Navyist Card | Old Navy Visa Card and Navyist Visa Card | |

| Annual Fee | $0 | |

| Purchase APR | 25.99% (variable) | |

| Cash Advance APR | N/A | 26.99% (variable) |

| Cash Advance Fee | N/A | $10 or 5% of the amount of the cash advance, whichever is greater |

| Minimum Interest Charge | $2 | |

| Foreign Transaction Fee | N/A | 3% of each transaction |

| Late Fee | Up to $40 | |

If there’s 1 thing to be said for avoiding unnecessary fees and penalties, it’s: to be a responsible cardholder.

What does this mean? Being a responsible cardholder means paying off your balance in full, each month, on time.

If for some reason you can’t achieve this, pay as much as you possibly can and at the very least, the minimum payment. This will ensure you either don’t carry a balance or carry the smallest balance possible to keep added fees and penalties low.

Why? Because the purchase APR for this card is a monster. It’s much higher than many of the alternative rewards credit cards you’ll see below and this percentage can get you into trouble very quickly if you carry a hefty balance.

Additional Drawbacks

Obviously, a major drawback of the Old Navy card and Navyist card is that the cards and rewards can only be utilized at Old Navy (and the Gap Inc. family of brands).

If you’re an avid Old Navy shopper, this isn’t likely to be an issue. However, if you want to diversify how you spend your rewards (i.e. earn rewards to spend them on whatever you want, whenever you want), you won’t find those options here.

Alternative Rewards Credit Cards (Recommended)

If you’re interested in any of Old Navy’s credit cards, then earning cashback is likely to be your main motivation here.

There are certainly other cards out there (see below) that could be more beneficial. For example, Chase Freedom Unlimited® earns 1.5% back on purchases outside of its bonus categories.

(at Chase’s secure site)

U.P. Rating

This all-purpose cash-back card offers great bonus categories, including bonus points for every purchase you make!

If you pair the Freedom Unlimited card with a card like the Chase Sapphire Preferred® card, then you could even convert that cash-back into Chase Ultimate Rewards and use those points for incredible flights and hotel stays.

Hot Tip: Rakuten offers cash-back (or American Express Membership Rewards points) for shopping at OldNavy.com and many of your favorite stores. You may also want to check Chase Offers and Amex Offers to see if any Gap Inc. brands are featured for bonus cash-back!

Individuals wanting to apply for an Old Navy Credit card can do so online or in-store.

Applicants do not get to choose whether they are applying for the basic version of the Old Navy card or the Visa version of the card: 1 application is submitted, and the card you’re approved for depends on your creditworthiness at the creditor’s discretion.

In general, most credit card review sites are in agreement that individuals with fair credit are likely to be approved for the Old Navy card, while individuals with good credit will likely be approved for the Old Navy Visa card.

*Remember, the Navy cards cannot be applied for; the upgrade in status must be achieved by points earned in a calendar year.

Some applicants may be approved instantly for this card, though some applications may require a review period of usually about 7 to 10 days. In some cases, we’ve even heard reports that individuals were initially declined online, yet received a follow-up phone call to review the information and were then approved. Follow-up approvals are pretty rare, but they can happen.

Login and Online/App-Based Account Management

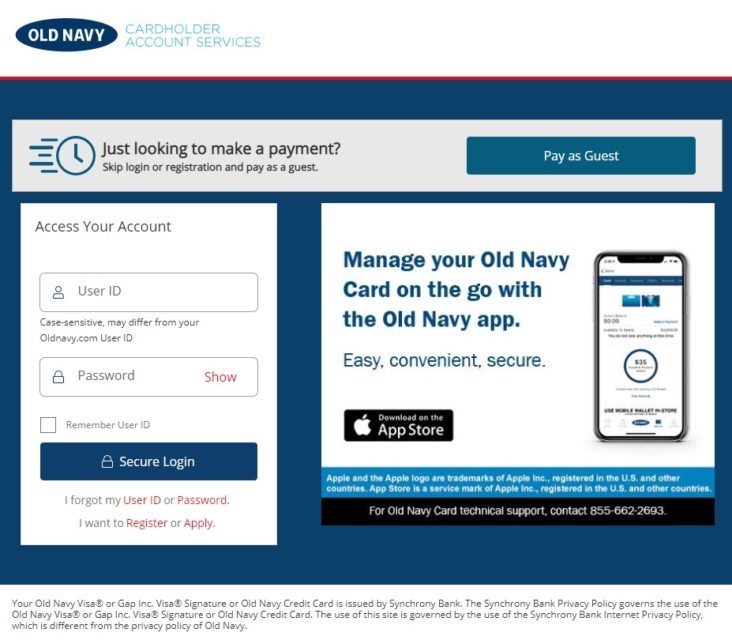

Online Management

Barclays provides a platform for Old Navy Cardholders to manage their account online.

If it is your first time utilizing the platform, you will need to register for an account. If you’ve already registered, log in with your username and password.

Within the platform, users have the following options:

- View account activity

- View billing statements

- Make a payment*

- Set up paperless statements (bonus points!)

- Set up alerts

* You can’t pay your Old Navy credit card bill in-store. Cardholders can pay online, by mail, or by phone.

Hot Tip: As an eco-friendly perk, if a user signs up for e-billing (paperless statements), they will receive 500 bonus rewards points. This bonus is a 1-time offer that will be issued within 2 billing cycles after signing up.

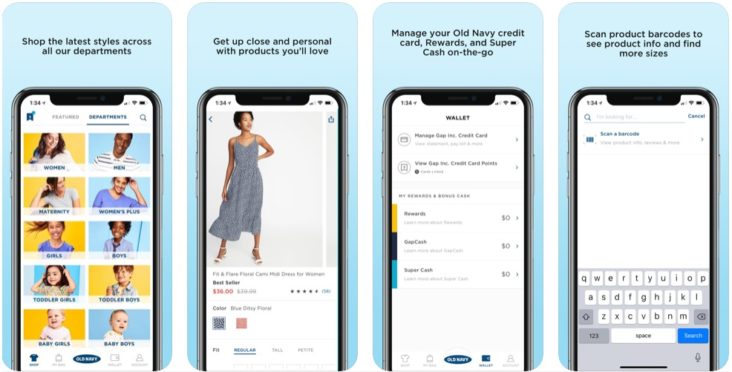

App Management

Alternatively (and likely more enticing for many), is the Old Navy mobile app (iOS) where cardholders can manage their account.

This app provides users with the ability to manage all aspects of the Old Navy rewards program through the wallet tab of the app.

This includes:

- Managing your Old Navy card

- Viewing statements

- Setting up alerts

- Paying bills

- Managing rewards and bonus cash

- Tracking progress

- Linking cards

Unfortunately, at this time the Android app doesn’t seem to have an option to pay your balance, but it DOES look like you can manage your rewards.

Final Thoughts

All in all, if you’re an Old Navy (or Gap Inc. family of brands) lover, you’re likely to benefit from this credit card if you can maintain a responsible payment strategy. This is especially true if you can achieve Navyist status.

Be sure to pay off your card on time every month to avoid the massive APR, and be sure to utilize your hard-earned rewards before they expire.

If you vary your clothes shopping among different stores outside the Gap Inc. family of brands, this likely isn’t the best card for you.

The Old Navy cards also aren’t for you if you don’t spend a lot on clothing and most of your expenses are geared more toward groceries, gas, dining, and travel.

Lastly, if you’re interested in working on your points and miles game, this card has no travel-based reward options. You’ll definitely want to look into other avenues to accrue these types of rewards.

The article was originally published here.

Zero fraud liability

Zero fraud liability A dedicated Navyist cardholder toll-free priority line

A dedicated Navyist cardholder toll-free priority line Chip and

Chip and

Comments are closed.