Gold Just Got This Contrarian “Soft” Signal

Spot Gold Price Chart: |For uponSay it ain’t so! In July, Vanguard made a seemingly routine announcement. It changed the name of a mutual fund.

What’s the big deal about that?

Well, Vanguard isn’t just any old mutual fund company. With $5 trillion in assets, it sets the pace for millions of customers simply by dictating what kinds of investment choices it offers. Spot Gold Price Chart.

So it’s a sign of the times — and a brewing opportunity — when a firm like Vanguard finally throws in the towel and decides to take the precious metals out of its flagship precious metals investment fund. Spot Gold Price Chart.

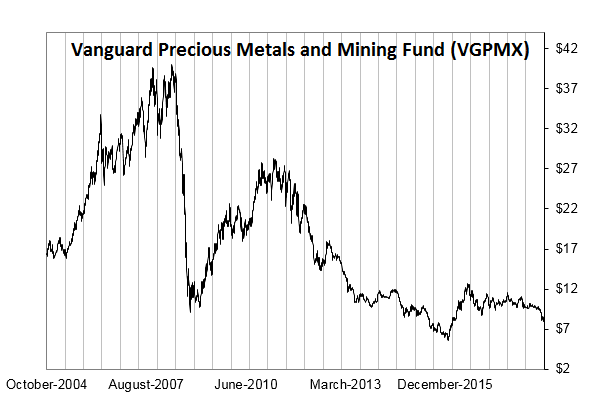

That’s right. Starting late this month, the Vanguard Precious Metals and Mining Fund (VGPMX) will be renamed and restructured.

Goodbye gold and silver.

Hello “Vanguard Global Capital Cycles Fund” (whatever that’s supposed to mean).

“Soft” Signals

I understand why Vanguard is doing it.

If your goal is to sell investment products, you’re not going to sell many when the asset in question is down 35% since 2012 and going seemingly nowhere but down as fast as the drip-drip-drip of a leaky faucet. Spot Gold Price Chart.

On the other hand, sometimes markets send what I call “soft” signals — if you’re willing to step back and take a contrarian view.

Mutual fund companies send those signals on a regular basis, in what they offer (and don’t) to clients.

For example, a little less than a year ago, ProShares offered the Decline of the Retail Store ETF (NYSE: EMTY). This exchange-traded fund must have seemed like a slam-dunk winner at the time. Spot Gold Price Chart.

It’s now down more than 23% from inception.

The famous BusinessWeek “The Death of Equities” cover in 1979 is another of these soft signals. After a decade of flat-to-negative returns, the headline must have seemed right on target to BusinessWeek’s editors at the time. Spot Gold Price Chart.

Any financial adviser of that era would have felt perfectly confident throwing in the towel and telling customers to skip the stock and bond markets.

One year later, the S&P 500 Index was up 20%. Four years later, the index rose by 60%.

Gold Is out of Favor … for Now

Granted, I’m cherry-picking examples here. It’s hardly a “cause and effect” phenomenon.

Then again, the yin and yang of contrarian market calls tend to echo through history, fooling experts no less than amateurs. Spot Gold Price Chart.

Think back from 1999 to 2002. The Bank of England decided to sell off a big chunk of the U.K.’s gold reserves. The central bank auctioned nearly 400 tons of the stuff.

Why bother owning it, the thinking went, when gold was at its lowest price (less than $300 an ounce) in 20 years?

You guessed what happened next. 1By 2004, gold was up 50%. By 2005, it doubled in price. By 2011, bullion was up more than 500%.

And here we are in 2018. Right now, gold is out of favor. It may become even more out of favor between now and the end of the year.

But my hunch is that Vanguard is sending us a bullish “soft” signal with its decision to rename its precious metal fund.

Kind regards,

The article was originally published here.

Comments are closed.